Developing new properties in disaster hazard zones might value billions, threaten affordability

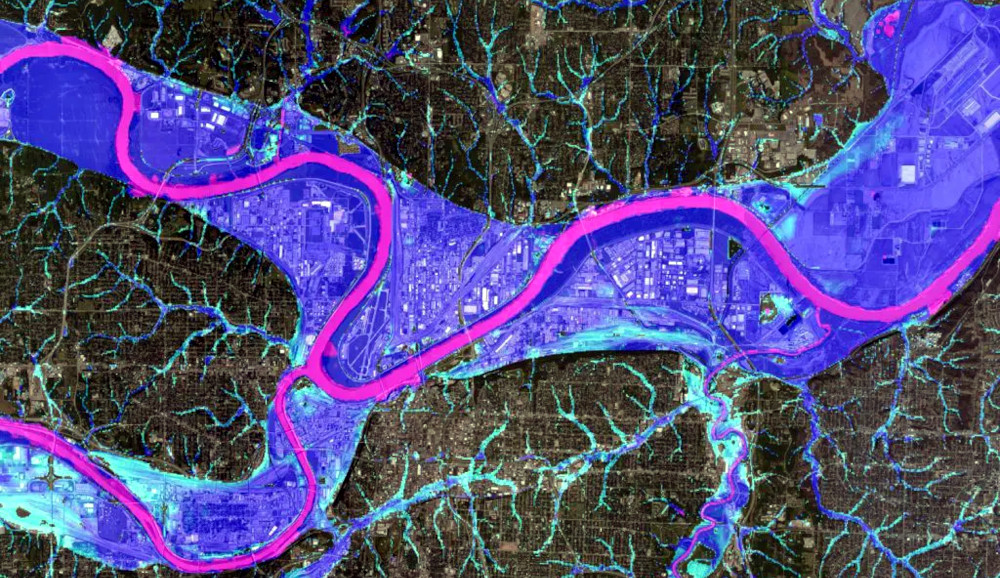

Image credit score rating: Fathom

Image credit score rating: Fathom

World

As is the case in most developed worldwide places, governments all through Canada are

racing to assemble further housing to boost affordability. However a model new analysis from the

Canadian Native climate

Institute

has found these efforts menace putting a number of of a whole lot of properties in harm’s

method — and together with billions of {{dollars}} in costs yearly — besides protection is

improved to direct enchancment away from the specter of wildfires and floods.

As Close to Home: The best way to assemble further housing in a altering

native climate

outlines, developing new properties in areas at a extreme menace of flood or wildfire might

value governments, insurers and homeowners as a lot as $3 billion further yearly for

rebuilding and disaster assist. These risks are neither distant nor abstract:

Damages from merely 4 extreme-weather events in July and August 2024 —

flooding

in Toronto and Southern Ontario, the catastrophic

wildfire

in Jasper, extreme

flooding

in Quebec and an historic

hailstorm

in Calgary — totaled larger than $7 billion in insured

losses.

One of many putting findings of the analysis is that a number of the projected

costs are associated to a relatively small number of properties anticipated to be

inbuilt flood-vulnerable zones: Redirecting merely three % of newest properties

away from the highest-risk flood areas might save virtually 80 % of all

projected weather-related losses by 2030.

“In all probability essentially the most fairly priced home is the one you would not have to rebuild after a disaster.

Governments all through Canada can save billions of {{dollars}} yearly and protect of us

shielded from disasters by developing solely a small share of newest properties away from

the highest-risk areas for wildfires and floods,” says Ryan

Ness, Director of Adaptation

on the Canadian Native climate Institute. “Our new report outlines the devices

policymakers ought to steer new housing to safer ground and help affordability

throughout the course of.”

The report — which contains wildfire-risk analysis from Canadian financial

firms company Co-operators, flood-risk modeling

by Fathom World and future housing menace analysis

by SSG — is a first-of-its-kind analysis in Canada to model

the financial costs of future floods and fires on new housing slated for

constructing by 2030.

It finds that larger than 540,000 properties is perhaps inbuilt areas of flood hazard

and larger than 220,000 properties in locations uncovered to extreme wildfire hazards by

2030. The associated full costs usually tend to be highest in British

Columbia — which faces $2.2 billion in added annual costs beneath a worst-case

state of affairs — adopted by Manitoba ($360 million), Alberta ($220

million), and Quebec ($214 million). The Yukon may even see will enhance in

frequent damages as extreme as $1,200 for each new dwelling from flooding alone, successfully

previous the nationwide frequent.

The Native climate Institute moreover commissioned a companion report, Indigenous

Housing and Native climate

Resilience,

by Shared Price

Choices

to find out distinctive challenges and obstacles confronted by Indigenous Nations in

rising climate-resilient properties, with a specific take care of housing on First

Nations reserves. The report examines worthwhile insurance coverage insurance policies and practices, and

presents 9 protection recommendations.

“Fixing Canada’s housing catastrophe requires not merely developing further properties nonetheless

guaranteeing they’re fairly priced in the long term. This consists of developing new properties

in protected locations that are resilient to an increasing number of excessive floods and

wildfires,” asserts Lisa Raitt,

Vice-Chair of World Funding Banking at

CIBC and Co-Chair of the Exercise Strain for

Housing and Native climate. “This new Native climate Institute

report highlights the financial risks Canada faces if housing protection continues

to allow harmful enchancment, and provides actionable choices to protect of us

and property.”

The report notes that every one ranges of presidency have a job to play in decreasing

the threats of utmost local weather disasters to new properties, and provides these protection

recommendations:

-

Federal, provincial and territorial governments must steer housing and

infrastructure funding away from high-hazard zones to low-hazard areas. -

Provincial and territorial governments must strengthen land use protection to

redirect new constructing away from areas at extreme menace of flood and hearth

hurt. -

Federal, provincial and territorial governments must reform

disaster-assistance packages to discourage harmful enchancment — as an example, by

making new properties inbuilt high-hazard zones ineligible for publicly funded

disaster compensation. -

Governments must create, protect and make publicly obtainable maps that

current hazardous areas — and mandate the disclosure of such information in

precise property transactions — so that homeowners, renters and builders have

entry to that information. -

The federal authorities must empower and help Indigenous communities to

assemble climate-resilient

properties

in safer areas inside their territories.

“Native governments, on the forefront of every the native climate and housing crises, are

necessary companions in safeguarding Canadians and defending communities from

escalating native climate impacts,” says Carole

Saab, CEO of Federation of Canadian

Municipalities. “This report highlights the urgency of coordinating all through all

orders of presidency and sectors to keep up Canadians and their properties shielded from

an increasing number of excessive wildfires and floods.”

Native weather-driven migration, insurance coverage protection will enhance might erase $1.4T in US precise property price by 2055

The LA fires, January 2025 | Image credit score rating: Maxar

The LA fires, January 2025 | Image credit score rating: Maxar

Within the meantime, First Avenue’s just-released twelfth

nationwide report estimates a attainable $1.47 trillion low cost in US precise

property price over the following 30 years attributable to climate-related risks.

First Avenue makes use of clear, peer-reviewed methodologies to quantify the earlier,

present and future native climate menace for properties globally and makes it obtainable

for residents, enterprise and authorities. In October, Zillow began offering

First Avenue’s data for five key climate-related

risks

on all for-sale property listings all through the US — serving to patrons to greater

assess long-term affordability and plan for the long run.

Drawing on interdisciplinary evaluation that examines native climate menace consciousness,

housing market dynamics, native climate migration patterns, and demographic and

socioeconomic shifts, First Avenue’s new Property Prices in

Peril report

offers a forward-looking analysis of the Housing Worth

Index,

property-valuation developments and localized GDP impacts extending to 2055.

Key findings

-

By 2055, climate-driven local weather phenomena are anticipated to increase home-owner

insurance coverage protection premiums nationwide by a imply of 29.4 % — the 5

largest metro areas coping with one of the best insurance coverage protection premium will enhance are Miami

(322 %), Jacksonville (226 %), Tampa (213 %), New Orleans

(196 %), and Sacramento (137 %). -

Concurrently, migration induced by native climate risks along with extreme heat,

wildfire and flooding is anticipated to drive necessary inhabitants

redistribution, with 55 million People anticipated to relocate contained in the US

over the an identical interval to historically a lot much less populous states resembling North

Dakota and Montana — which are forecasted to develop attributable to their native climate

resilience.

“Native climate change is just not a theoretical concern; it is a measurable energy

reshaping precise property markets and regional economies all through the USA,”

acknowledged Dr. Jeremy Porter, Head of

Native climate Implications Evaluation at First Avenue. “Our findings highlight the

urgent need to understand how rising insurance coverage protection costs and inhabitants actions

are remodeling the monetary geography of the nation.”

The analysis duties a stark divergence in property values: Extreme-risk areas are

extra prone to experience necessary devaluation, whereas areas perceived as

native climate resilient are

poised to study from elevated demand. This reallocation of economic train

might have profound implications for native authorities revenues — with at-risk

areas coping with reductions in property tax earnings, whereas further resilient areas stand

to realize.

“These outcomes highlight not solely the pressing challenges however moreover the

options for adaptation and

innovation

throughout the face of native climate change,” added First Avenue founder and CEO Matthew

Eby. “Policymakers, firms and

communities ought to act now to mitigate risks and capitalize on the rising

monetary options in a shifting panorama.”